Medicare Advantage Overpayments: MedPAC Says Taxpayers Lose $76B

Nowadays, every other patient 65 and older is enrolled in a Medicare Advantage (MA) plan (assuming they're a Medicare beneficiary). These plans promise lower premiums and extra perks like dental and fitness coverage—attractive for patients! But the business model behind MA—specifically, its capitated payment structure—is what makes it even more attractive for payers.

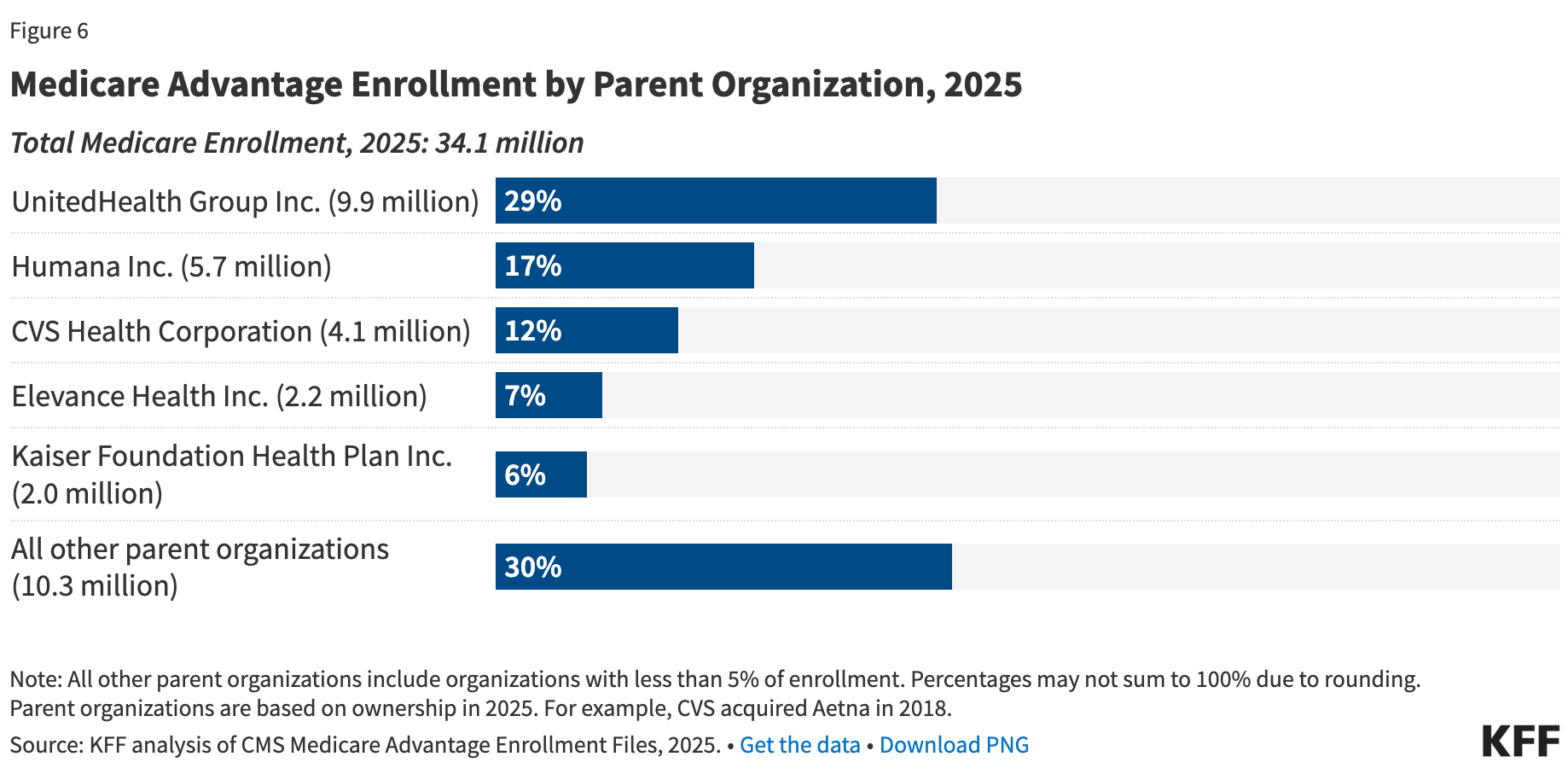

The largest payers have flocked to the MA market over the past two decades. Six payers now control 70% of the market.

While the goal of MA was to save taxpayer money by privatizing Medicare, the government pays MA plans tens of billions of dollars more for beneficiaries than it would had they stayed in traditional fee-for-service (FFS) Medicare.

In this article, I'll provide some brief background on MA, dive into the business model and MedPAC's recent report highlighting overpayments, and tell you how this impacts patients, physicians, payers and the health system.

Medicare Advantage 101

Medicare Advantage is managed Medicare. The Tax Equity and Fiscal Responsibility Act of 1982 opened the door for private insurers to contract with Medicare and offer managed care plans—planting the seeds of what would become Medicare Advantage. Twenty years later, the Medicare Modernization Act of 2003 made Medicare Advantage official.

The idea was attractive for both the government and patients: private insurers would offer Medicare coverage with added perks and coordinated care—ideally at a lower cost to the government. If done right, everyone would win:

The government saves money

Seniors get extra benefits

Insurers make a fair profit

MA plans took some time to find their footing. Growth really picked up in the late 2010s and is now slowing in 2025. Currently, 54% of all Medicare beneficiaries are enrolled in an MA plan, up from 53% in 2024. The Congressional Budget Office estimates that two-thirds of all Medicare beneficiaries will be enrolled in an MA plan by 2034.

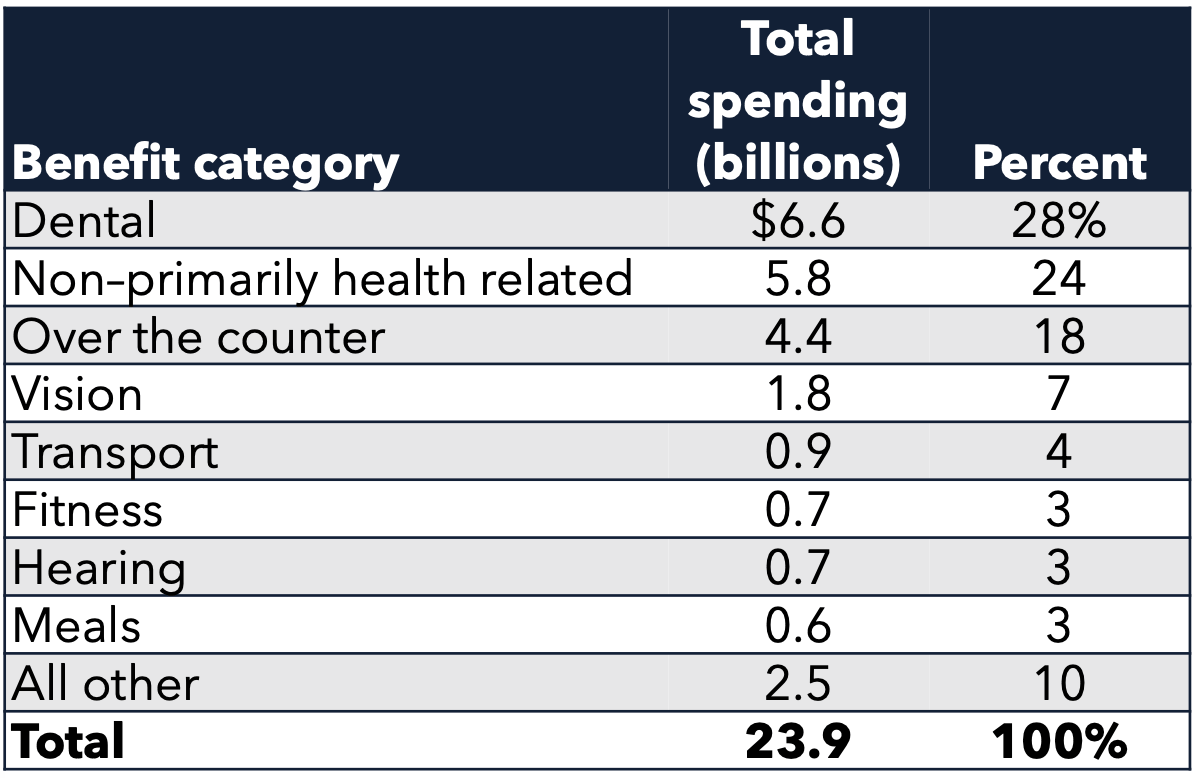

The non-medical benefits and lower premiums are what make MA plans attractive for patients. In 2023, MA plans spent $24 billion on non-Medicare services—things like dental coverage, transportation, and fitness memberships.

Source: MedPAC

The reimbursement model (which I'll explain in the next section) makes MA attractive for payers. Under capitated payment, payers receive a flat rate per member—allowing them to optimize operations and maximize profit. Payers of all sizes have entered the market. As I mentioned earlier, six payers now control 70% of MA.

Source: KFF

UnitedHealth Group controls nearly 30% of the market. They've also figured out how to game the system, raking in billions in profit. Let's get into the meat and potatoes below.

The Business Model Behind Medicare Advantage

In this section, I’ll first explain simply how the MA model works, discuss the drama happening (right now) with UnitedHealth Group, and highlight a recent MedPac report, showing the government is not saving money on Medicare Advantage.

The Reimbursement Model

Medicare Advantage is simple in concept: CMS pays the plan a fixed monthly amount per member. The plan’s job is to deliver all covered care for less than that monthly check.

The monthly check has two parts:

1) A base rate payment (set by bidding + benchmarks)

Each year, plans submit a bid for what it will cost them to cover the “standard” Medicare benefits in a county.

CMS sets a county benchmark using local FFS Medicare spending as the baseline.

If a plan bids below the benchmark, it gets its bid plus part of the difference (the “rebate”).

That rebate is where plans find room to fund the perks patients love: dental, vision, OTC cards, gym, transportation.

The goal is to bid smart, win a spread, use the spread to buy benefits and growth.

2) A risk score (the multiplier)

CMS then adjusts payment based on how “sick” a member is, using risk adjustment.

More documented conditions → higher risk score → higher monthly payment.

Put those together and the business model becomes an optimization problem:

Profit = (CMS monthly payment) − (actual medical spend)

So plans have two obvious strategies:

Increase the numerator: document more diagnoses (risk adjustment) and earn quality bonuses (Stars).

Decrease the denominator: control utilization (networks, prior auth, care management, delegated risk).

That’s the whole game. Everything else in MA is a more sophisticated version of those two levers.

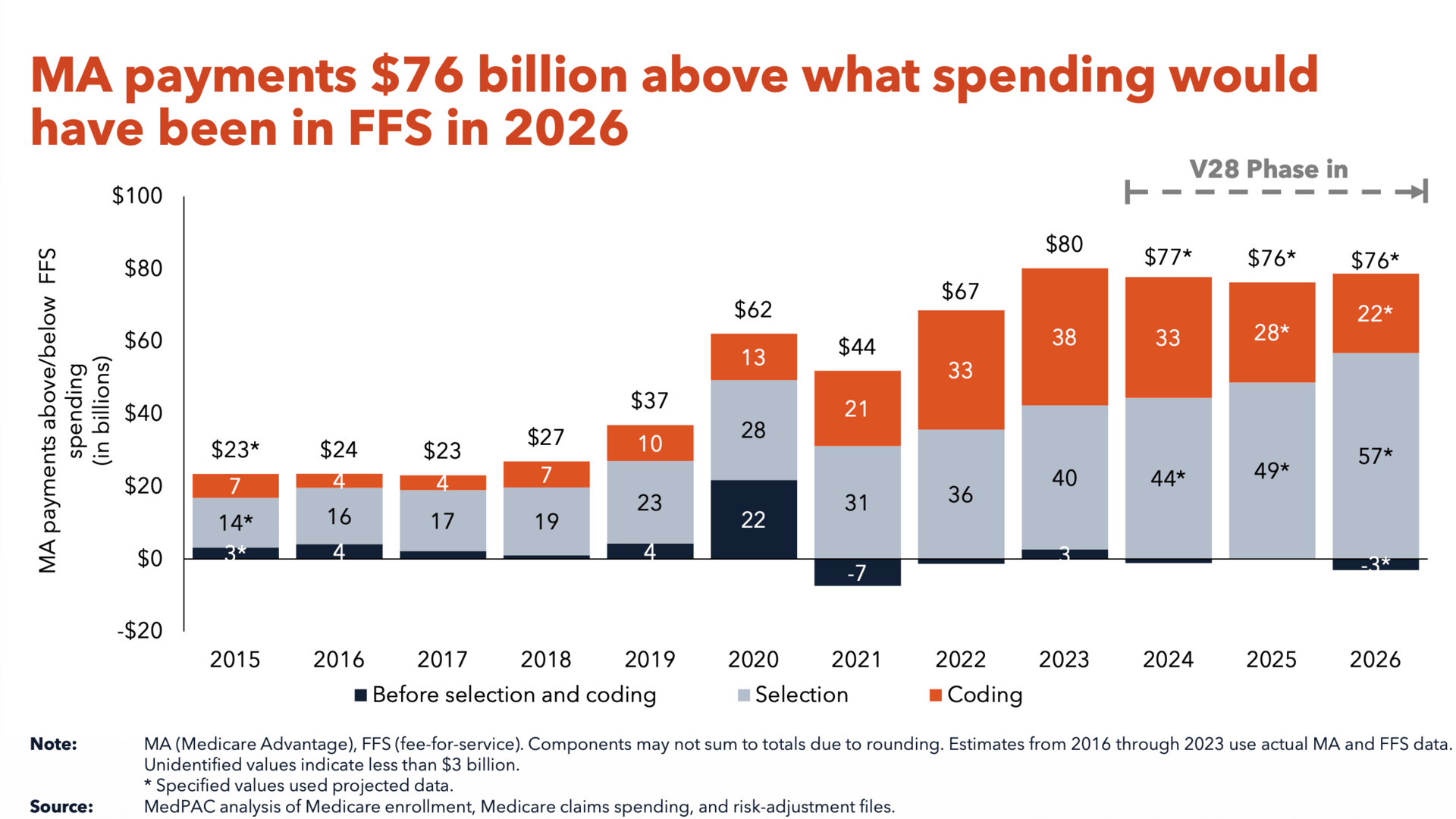

The Government Will Overpay MA Plans by $76 Billion

According to the most recent MedPAC report, the government will overpay MA plans by $76 billion compared to what it would have spent on traditional fee-for-service Medicare. In other words: switching these beneficiaries from traditional Medicare to Medicare Advantage costs taxpayers an extra $76 billion.

Source: MedPAC

There are three main reasons for the higher spending:

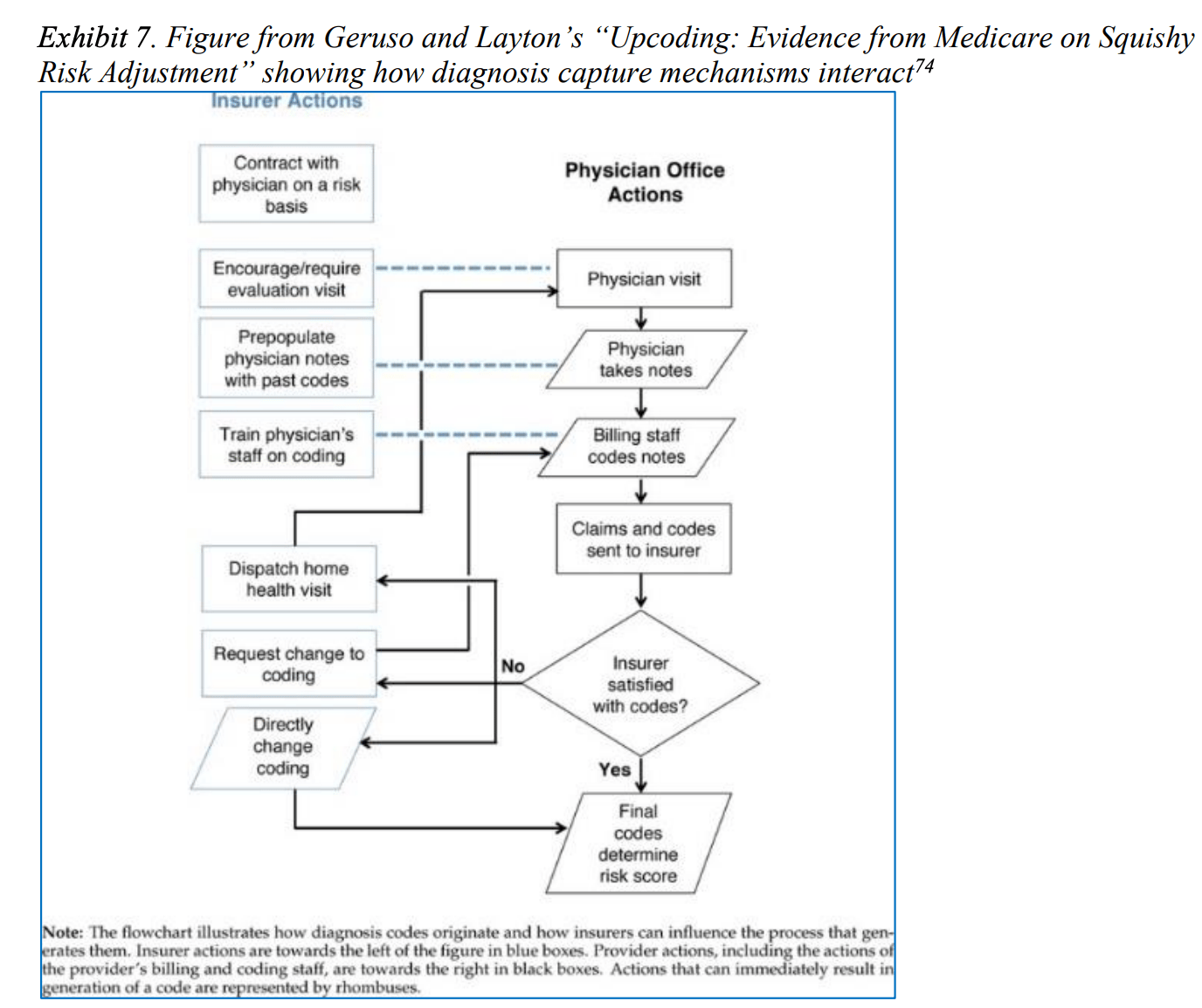

Coding Intensity (Upcoding): MA plans document every possible diagnosis to inflate risk scores and increase government payments (higher risk scores = higher monthly payments). MedPAC estimates this adds 4 percentage points to MA spending compared to traditional Medicare. Aggressive tactics like in-home assessments that capture diagnoses without follow-up care lead to billions in overpayments.

Favorable Selection: Healthier seniors enroll in MA, leaving sicker patients in traditional Medicare. This raises FFS spending averages, which artificially inflates MA payment benchmarks. MedPAC estimates this accounts for an 11 percentage point spending increase compared to traditional Medicare.

Payment Policy Inefficiencies: CMS benchmark rules often pay MA plans more than traditional Medicare would cost. Benchmarks range from 95-115% of FFS spending, with intentional overpayments in low-spending counties. Plans with 4+ Star Ratings (higher ratings = bigger bonuses) get 5-10% bonus payments—costing $13 billion in 2024 alone.

Spending has decreased slightly, thanks to a new risk model called V28. This model uses a more refined method of calculating risk scores—focusing on chronic diseases (like HFrEF defined by severity) rather than acute, resolvable issues (like acute kidney injury). Payers, obviously, do not like this.

Payers Game the System

UnitedHealth Group (UHG) and other major insurers have turned risk adjustment into a profit-maximization game. Remember the equation from earlier? One key to maximizing profit is maximizing risk coding. The Senate is now investigating UHG for transforming its MA risk adjustment tactics into a major profit-driven strategy. They do this by leveraging their massive scale, vertical integration, and data analytics capabilities. UHG's ownership of both the insurer (UnitedHealthcare) and the provider/data arm (Optum) creates a feedback loop that maximizes coding intensity.

Some of their tactics:

HouseCalls: Nurse practitioners visit enrollees at home to conduct health risk assessments. The report found that 60% of these visits generated at least one new revenue-producing diagnosis—with UHG earning the most per assessment compared to its peers. UHG adopted the QuantaFlo device to screen as many enrollees as possible for peripheral artery disease, even those without symptoms. This allowed them to capture vascular disease codes that traditional providers—who don't routinely screen asymptomatic patients—would never report.

Internal Oversight: UHG uses “Cohort Programs” and “Ride Along” audits to track providers. Those who document fewer diagnoses than average receive individualized training to improve their "capture" rates.

Source: Senate Judiciary Committee

Software-Driven Prompts: The eHouseCalls software uses logic rules to automatically populate suspected diagnoses into a "diagnosis cart," prompting providers to confirm conditions based on existing data or screening results.

Secondary Hyperaldosteronism: UHG taught providers to reflexively diagnose this condition in patients with heart failure or cirrhosis taking common diuretics. Because this diagnosis mapped to a different category than heart failure itself, it allowed them to stack unrelated diagnosis codes for what was essentially a single disease process.

The investigation concluded that risk adjustment in Medicare Advantage has become a “business in itself,” where UHG prioritizes its knowledge of coding rules and its ability to expand inclusion criteria over actual patient outcomes. The report notes that UHG appears to leverage its data analytics to stay ahead of CMS's efforts to counteract unnecessary spending.

Dashevsky’s Dissection

I think MA is durable because it’s a rare program where the incentives line up for almost everyone except the taxpayer. Seniors like the perks. Plans like the margins. And CMS has built a payment framework that makes “optimization” the rational corporate move.

Impact on patients

On the surface, MA is Medicare with better marketing.

Patients get lower premiums and extra benefits (dental, vision, transportation, OTC, gym). But the trade is subtle: those benefits are funded by capitation economics, and capitation rewards tight control over where and how care gets delivered:

Narrow networks become normal.

Prior auth becomes routine.

Out-of-network care becomes financially painful.

When you’re healthy, MA can feel like a steal. But when you’re sick… it’s far from a steal.

Impact on physicians

MA is one of the clearest examples of the system turning clinical work into an administrative game. Risk adjustment pulls physicians into documentation-as-business-strategy.

More "diagnosis capture" work.

More chart bloat.

More coding-driven workflows.

On the cost side, utilization management becomes a daily battle—even when denials get overturned, we still pay with time. This leaves less bandwidth for actual medicine and more bandwidth spent proving medicine should be allowed.

Impact on payers

From a business standpoint, MA is an optimization machine.

CMS set the rules. Plans are just playing them.

Risk adjustment: rewards plans that build the best coding infrastructure.

Star Ratings: reward plans that can execute quality measures at scale.

The bid-rebate structure: rewards plans that can bid strategically and design benefits that drive enrollment.

Capitation makes cost control rational. If you’re paid a fixed per-member-per-month rate, you build systems that keep medical spend below PMPM. That leads to network design, prior auth, delegated risk, and aggressive care management.

If you’re a public company whose job is to maximize shareholder value, why wouldn’t you do this?If you don’t pull the legal levers available to you, a competitor will. And Wall Street won’t care that you were “less gamey.” I’m not saying this is “good,” but when you view this from the business point-of-view, it makes complete sense.

Impact on the health system

MA shifts Medicare into a managed premium program, and the money increasingly flows to whoever can best manage (and capture) that premium. This accelerates consolidation and vertical integration. Owning the plan, the pharmacy infrastructure, and the care delivery arm creates a compounding advantage. Look not further than UnitedHealth Groups model!

Once most seniors are in MA (note, the aging population), reform gets harder. CMS can tighten risk models (V28), audit more, and regulate prior auth. But unwinding the core economics becomes politically toxic.

In summary, Medicare Advantage has become a high-stakes optimization game where payers profit by maximizing risk scores and minimizing care costs, while taxpayers foot a $76 billion annual overpayment bill. Patients trade comprehensive access for perks and narrow networks, physicians spend more time on documentation than medicine, and the system rewards vertical integration over actual health outcomes. As MA enrollment approaches two-thirds of all Medicare beneficiaries by 2034, the program's economics—and the corporate strategies built around them—become harder to reform. What started as an experiment in managed care has evolved into a business model that works brilliantly for insurers, adequately for healthy seniors, and expensively for everyone else.